GST Validation Report

In Current period, while assessing a credit proposal, banks/NFBCs call for last 12 to 24 months sales figures on client letter head from the prospect borrowers/ existing borrowers to understand their sales turnover and try to match it up with their submitted financials. Bank also calls monthly/quarterly/yearly GST return copies for their assessment and to understand the statutory payment pattern and its timely adherences.

Collection of GST related papers and information from borrowers is tedious job and it also depends on borrower’s financial consultant’s time and availability to provide these documents as most of the borrowers are dependent on their financial consultants for GST related information.

Fundupay Solution API for GST Verifications.

- GSTN is OTP consent based API

- User prompted OTP based GSTN solution through registered Mobile number/Email ID

- Format of GSTN Report would in Excel /PDF form.

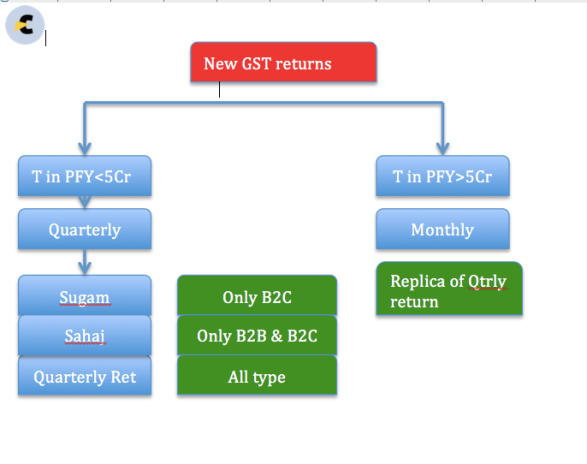

- 2 Types of GST report A. GRC report (Basic Information on GSTN filled/not filled per month for last 12 months) and B. GSTN report with consent through OTP.

- User can generate report upto 12 month.

- GSTN data available from 2017 onwards

- In GST report different data points captured running in 10 to 15 pages.

With the output report based on GST number prompted through OTP, User will get maximum information based on full report and it will support user to decide on clients proposal and fund requirements.