Loan Operating Systems

In Current scenario most of the co-op banks and NBFCs are doing assessment of Loan proposal manually by taking physical documents from prospect borrower with initial documents verification, recalling pending documents, sending it to immediate senior officer for assessment, again documents verification and calling short documents, finally it goes to Risk authority wherein Risk officer also go from scratch to re-check the documents and asks for additional information/documents.

In whole process there is absenteeism of TAT ( Turn around time ) as well as borrowers doesn’t know about the status of his proposal which gives very shabby picture about banks image and brand in their dedicated markets.

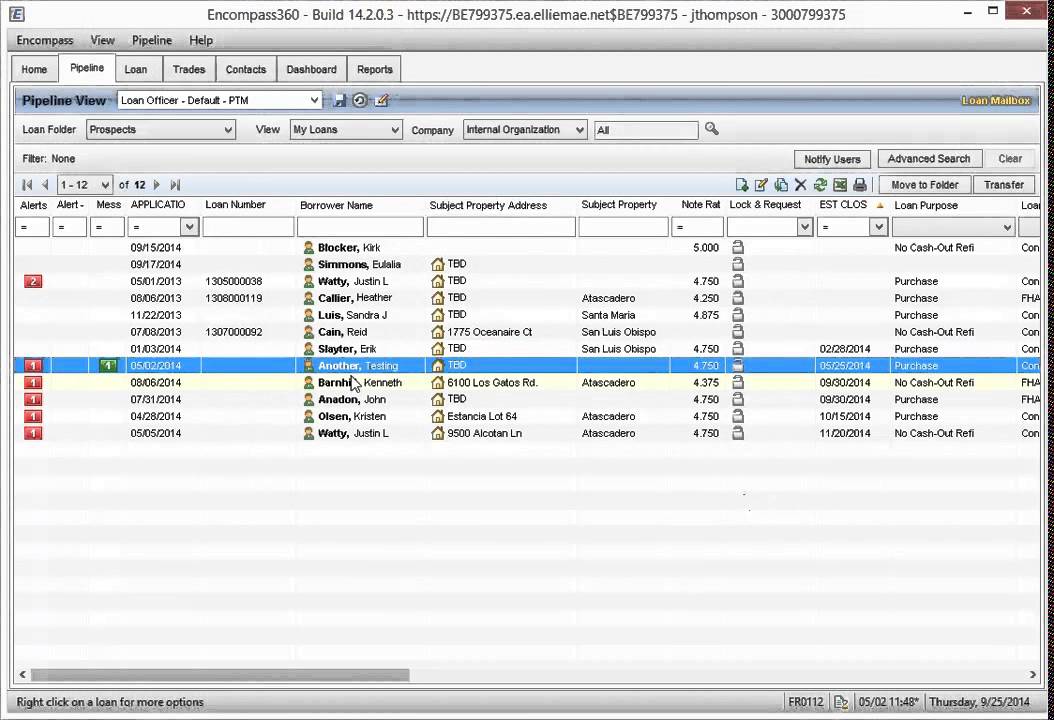

At Fundupay, we have LOS system which is user friendly and easy to manage with formats of proposal assessment, basic checks, upload of financial data, ratios analysis and Time tab of each officers proposal in his bucket.

LAS will help banks/NBFCs to save their time on rechecking of previous job as It is already captured by LOS system through previous officers work on the proposal , as well as it will help in speedy decision making for the senior officers.